What to expect at Robert Wu's Portfolio

Welcome to Robert Wu’s Portfolio, by Robert Wu, CEO of a data & research company and an infatigable writer of several substack newsletters, including:

- , an explainer on political, cultural, and historical context to help China start to make some sense to you.

- , the only newsletter on the professional data, information, and research industry in China and broader Asia.

- , about AI, consciousness, and other mystic powers of our universe

This Subtack, Robert Wu’s Portfolio, will be a finance newsletter focused on sharing my thoughts, strategies, and performance updates for my personal equity portfolio.

I first touched the stock market in 2009, at the beginning of my college years. But I didn’t seriously invest my money until 2014. Since then, I have kept an investment journal and have tracked my performance, and investing has been an integral part of my life and daily thoughts. A few years ago, two of my friends also entrust me with some money in this portfolio, with no management fees but only performance bonus, only to be paid when they withdraw.

For me, stock investing is one of the most enjoyable activities there is.

First of all, investing is multi-disciplinary, requiring knowledge as diverse as accounting, economics, statistics, probability, geopolitics, chemistry, mechanical engineering, cryptography, and, very importantly, psychology and behavioral sciences. Above all, it offers a unique opportunity to glimpse into myself. My biases, my strengths and weaknesses, my illusions and delusions, and my many fake comforts and real discomforts. I recall someone once saying that investing is the last liberal art. As a liberal arts person, I take this characterization dear to my heart.

Another great aspect of stock investing is that it’s results-oriented. It is a clear, quantifiable weighing machine. You may have many fanciful thoughts, you may have a great deal of confidence in yourself, and you may have a very specific idea of what is right or wrong. It doesn’t matter. Only your performance matters in the end. Right or wrong, rest assured, there will always be an answer.

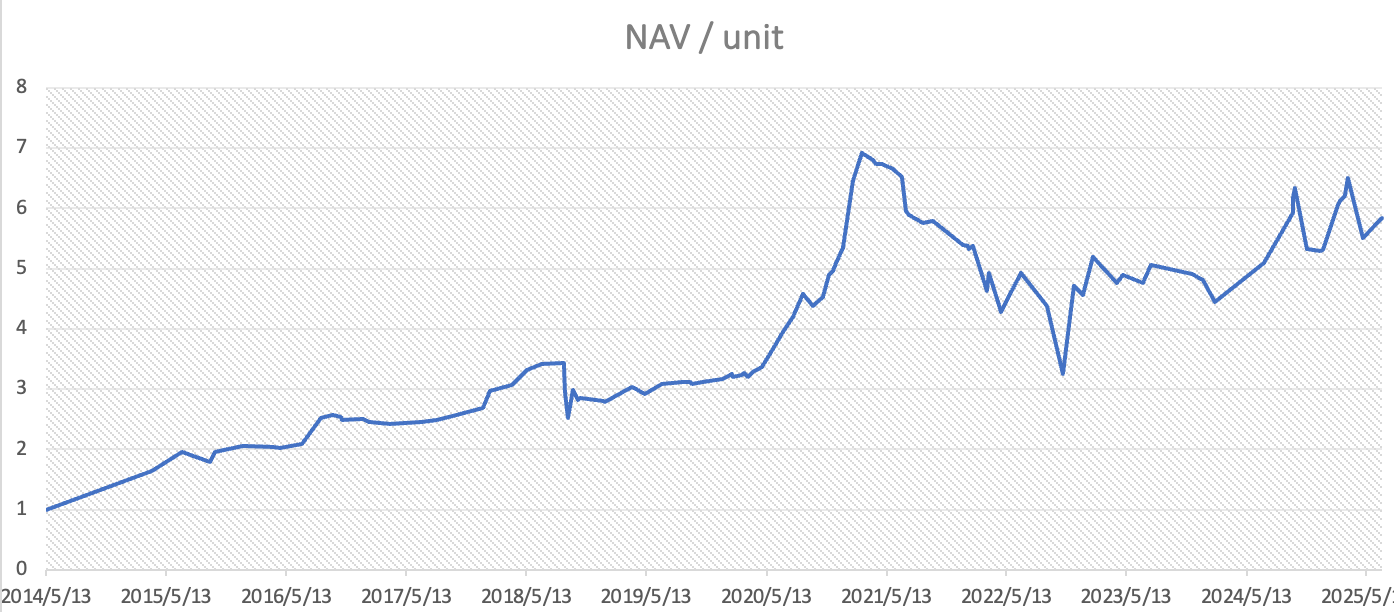

Today, on June 30, 2025, the net asset value (NAV) per unit of my portfolio stands at 5.84. This means that since May 13, 2014, when I started keeping track of my own performance, until the writing of this Substack, my overall return is 484%. In comparison, my main benchmark, The Hang Seng Index (since between 70% and 80% of my assets are invested in Hong Kong stocks), returned a dismal 6% over the same time frame. The S&P 500 and NASDAQ, the main global benchmarks, returned 229% and 396%, respectively during the same period. My results are clearly not stellar, and I know plenty of people who have done better, and much better than I have during the same time, but my own results are quantifiably above the average, which makes me even dare to start writing this newsletter.

This newsletter will make my investment returns, portfolio construction, and the thinking behind public for all the subscribers to see.

My own motive is very simple: I see this newsletter as a way to discipline myself and help me find blind spots in my thinking. Maybe I am wrong about something (I am almost always wrong), and maybe there is something missing in my thinking. By writing, I will first have to rigorously think about what I know and what I don’t know, and instead of keeping to myself, why not expose myself to you so you can help me correct those mistakes?

But checking my mistakes and following my investment return clearly can not be your motive, which comes to the third beauty of investing: investing helps broaden a person’s views. It’s a highly efficient way to wield one’s intellectual curiosity about the world we currently live in. With all the dramas, chaos, excitements, bold dreams and dangerous illusions in the world, what’s a better way to study about them than putting your own stakes on the table? With this newsletter, I invite you to take this intellectual jump along with me.

Investment style

This should go without saying: I may talk about specific stocks, but this newsletter is in no way investment advice for you. You invest with your own judgement and read my content at your own peril. And I strongly suggest you to always challenge my ideas, not to follow them.

The main reason for not blindly following someone else’s investment ideas is that each person has different life experiences and will have a very different set of beliefs, limitations, and appetites. Those unique features of a person will inform very unique decisions which will only work for that person and that person alone.

In this spirit, it will be helpful for me to discuss my main limitations and style in this inaugural post, so that you can have a point of reference.

First, here are some basic facts about my limitations:

I am a part-time investor. My main job is the CEO of a data & research company, and I have quite a few big ambitions for our industry. The advantage of working in this industry is that we have some soft informational edge, both in terms of the massive data we process and of the diverse client base we work with. So we are roughly in the know for some of the major questions of the day, but investing on a part-time basis also limits me from conducting deep research on any given topic.

Although I am globally literate, I am primarily based in China. I do not think I have much of an edge in non-China areas.

This is an equity portfolio of someone in his mid-30s, setting aside the capital that he would not need for a super long-term, so the stomach for volatility may be much higher than you feel comfortable with. This portfolio invests almost nothing in debt assets.

I am intellectually curious. Sometimes, I may even value intellectual growth over asset growth. This kind of bias can be clearly wrong from a profit-maximization point of view, but I don’t care.

These limitations help shape my particular investment style:

It’s a thematic-driven, sector-driven approach. Top-down first, bottom-up second. This means that I will look for long-term secular trend first that holds great promise, and will start to identify the leader(s) and the best strategy to position for this trend. Therefore, expect more Citrini-style writings about industry trends, rather than deep research on any single ticker. This also means my attention to detail will be weaker than desired, and you will not spend much time parsing over a financial report with me. My focus is on getting the key questions right. Better be roughly right, than precisely wrong.

It’s a China-heavy portfolio. As of now, ~80% of it is in China, 20% non-China. “China” means that it’s either listed on H and A shares or has businesses that are predominantly affected by what’s going on in China. It’s not because I am too emotionally biased for China. Instead, it’s just a function of my familiarity with China over any other geographical region. In terms of portfolio construction, I am clearly NOT a Sharpe/Markowitz/Miller type of guy, who believes in a balanced portfolio, minimum volatility and high Sharpe ratio. I am clearly a Shannon/Kelly/Buffett type of guy, so I believe I ought to only bet on things I understand better, and size my positions according to my level of confidence.

It’s an aggressive portfolio. 2/3 of my portfolio is in what I call “26 Compounder”, which I define to be a stock whose EPS has a high chance to grow 26% annually for 3-10 years. Assuming valuation level stays the same, a 26% EPS CAGR for 3 years translates to a doubling of return, and a 10-bagger in 10 years. The other 1/3 is in what I call “15 Compounder”, stocks whose EPS growth + shareholder return yield can be a combined 15%. I will talk more about these two kinds of compounders in the future posts.

Entry price is important. One big consequence of being a part-time investor is that I can’t follow the market movements very frequently, so I can’t expect to make profits on short-term market swings or short-term fluctuations in fundamentals, but can only hold stocks for the long term. Therefore, the entry price for any major position is very important for me. Even if the opportunity is huge, I will still balk at unattractive prices, otherwise I can still lose money even if I am directionally right.

I want the portfolio to be concentrated, but right now it’s too fragmented than I desire. Currently the top 10 positions of my portfolio account for around 55% of value (although my top investment theme accounts for more than 40%). Ideally I want top 10 positions to account for 80%+, because as I said I am a Kelly believer, believing in maximizing positions according to my level of confidence. The lower-than-desired 55% reflects two things. 1) As of now I am not that confident of some of my top holdings; and 2) I am just too curious to lose sight of some really interesting stories. So if a new thing comes out, and before I am convinced by it, I might just place a tiny bet of ~0.1% of my portfolio, if just for the sake of learning new knowledge. In this sense, some part of portfolio is no different than a real-money stock watchlist.

I may not want to hold forever the stocks that I love, and will sell when the market goes crazy. The China markets, especially Hong Kong market, cycle through extreme pessimism and extreme euphoria every 3-5 years. This is actually a great thing for a patient investor. You can always find tough enough time to start to buy, and always find crazy enough time to dump your shares to the willing buyers. In this sense, Mr. Market is the true friend of a long-term value investor, and we should embrace him dearly.

There can be occasional shorts. I know from guts that shorting is wrong for a personal portfolio. The risk/reward profile of a naked short just doesn’t make any sense, and I got burned by shorts many times before. But there still are some occassional shorts in my portfolio (~9% at this very moment). Two reasons. First, I am still young and curious, so I want to try it out fully before I say “I get it”. Second, there are just companies I hate to exist, and I want to live through their downfall with some stakes on the table. Over the years, I have also developed a “Three NOs” rule for shorting: No long-dated short, no big short, and no shorting on the strong names. I may explore that in detail in future posts.

Lastly, I want to address the question of expectation.

I want to warn you that I will have more questions than answers in this newsletter, at least for now. I will not pretend I know more than a tiny portion of what I should have known.

Again, investing for me is a big way to satisfy my own curiosity and to help myself grow intellectually, while writing this newsletter can help me put more discipline on myself. This means that reading this newsletter will not be like having a mentor or a guru, but a study companion in our respective journeys.