In Part 1, I discussed how I position myself for my largest themes, including China's consumption, global decoupling, generative AI, and trading on momentum. In this article, I will discuss why I invest in copper.

Copper

Copper is a big sub-theme of my “global decoupling” theme. It’s one of my most important views, accounting for ~12% of my total portfolio at the moment, so it deserves a standalone section here.

A few years ago, I asked myself: in a world where the dominant power (the USA) and its currency (the USD) are being called into question, what asset class can generate safer returns? I was pessimistic about anything related to fiat money or any financial instrument that can only thrive when the world becomes more interconnected and globalized, which includes stocks and bonds. Although I have a long-term conviction of China’s capital market, I can’t bet on that alone.

This thought led me to cryptocurrency, particularly Bitcoin. It also led me to commodities, hard physical assets that the world can’t get by without. Naturally, my next question was, what commodities would benefit the most from such a world?

The no-brainer answer is gold, and I did buy some gold. But I was not satisfied. So I did some research about the world of commodities. Specifically, I was looking for a type of commodity that has a strong and long-term supply and demand profile, allowing me to always buy it at a dip without much consideration. Again, I am not a full-time investor (see my investment style and limitations), so not having to think too much is very important to me.

This philosophy eventually led me to copper.

For those familiar with copper, this article may be a bit boring. But for those who are not, here are some of the key traits that you have to know about it.

On the supply side, copper is rare. Yes, this is something I hadn’t realized until I did some research. For a metal element as frequently heard as copper, you would think it could be commonly found in the world. I wish my high school chemistry teacher had taught me this, but that’s just not true.

I asked Google Gemini to pull out a ranking of major metal elements, and here it is:

Several important facts here:

Although in the public consciousness, copper occupies similar “mind share” as iron and aluminum, the fact is that the latter two metals are more than 1,000x more (!) abundant than copper.

Titanium, a metal people usually associate with “high quality”, is ~100x more abundant than copper.

Zinc and Nickel are at similar levels of copper, but their usage case is far narrower than copper.

Copper is almost as rare as Neodymium, part of the so-called “rare earth metals”.

Lithium is rarer than copper. However, lithium mines are much easier to establish than copper mines. The main source of lithium is the lithium-rich brines. Mining it involves simply pumping the brine from beneath the salt flat into large solar evaporation ponds. On the other hand, modern copper deposits have an average ore grade of less than 0.6%, which forces mining companies to dig and process enormous amounts of rock to extract a viable amount of metal.

Given such scarcity, it is simply extraordinary that copper looms so large in the public’s mind. I imagine that if someone were to conduct a survey and create a chart about it, with the x-axis representing scarcity and the y-axis representing public recognition, copper would be the outlier, sitting way up in the upper-right-hand corner as this “best known but most scarce” metal.

The key reason for this outlier position is that copper is so instrumental in modern lives. Again, this is something I wish my high school chemistry teacher could have taught me: copper is primarily used for its property as a great conductor of electricity, and there aren’t any viable alternatives for it.

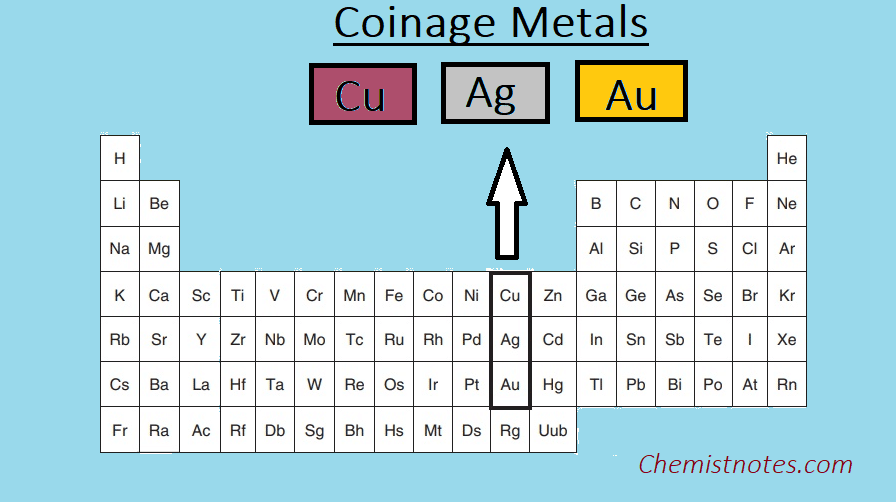

If you look at the periodic table, all of the best conductor materials for electricity all sit in the 11th column. They are therefore called Group 11 elements. The key feature of this group is that they have only one electron on their outer orbits. This trait, combined with other factors, give these metals the perfect combination: a single, highly mobile electron per atom, traveling through a lattice where the atomic cores offer very little interference, resulting in an exceptionally low electrical resistivity.

Group 11 is also called the “coinage metals”. Because they are copper, silver, and gold. Yes, silver has even higher conductivity than copper, but you won’t afford a silver cable, and you should forget about getting a gold cable, too.

There is also a fourth element, roentgenium (Rg). It is extremely radioactive and can only be created in a laboratory. Only a few atoms have been recorded in human history. Perhaps you should consider giving up on that as well.

Aluminum can also be a substitute, but due to its numerous weaknesses, it has never been able to properly challenge copper.

So copper is all you have for conducting electricity. Because our world literally runs on electricity. Electricity to us is like water and food, copper becomes so important in the public’s mind.

Now, at the same time, we have a scarcity of supply, and at the same time, an indispensable and non-replaceable demand for this metal. But for any investor, we always pay attention to marginal changes. After all, what has happened in the past has already been priced in; it’s only the marginal changes that will matter for the future.

So what will supply and demand for copper look like in the future?

The supply will get ever tighter, and the demand will get ever larger.

The picture for the supply side is highly certain. On the one hand, the average grade of copper ore (meaning the actual content per mass of ore) being mined has consistently dropped over many decades. This means that mines must dig up and process a significantly larger volume of rock and consume more energy to produce the same amount of copper metal, translating to rising production costs and a larger environmental footprint (such as more waste), making new projects less economically attractive and more difficult to permit.

If we look at the world’s existing mines right now, many of the world’s largest, highest-grade copper mines are decades old. As these mines mature, they are forced to process lower-grade material, leading to declining output despite continued investment. Moreover, the hard fact is that major, high-grade copper discoveries are becoming increasingly rare, meaning the pipeline of future projects is weak.

What if you want to invest more heavily to find new mines? As the environmental and social scrutiny has intensified globally, the average time from discovering a new copper deposit to a mine becoming operational has increased to approximately 17 to 18 years. This long lag makes it impossible for the industry to respond quickly to sudden spikes in demand.

All of this is making the copper supply chain extremely fragile. Early this month, Grasberg, the world’s second-largest copper mine, had a deadly catastrophe that knocked so much production off the market that Goldman Sachs had to shift its 2025 global copper balance projection from a surplus of 105,000 tons to a deficit of 55,500 tons.

The demand side is less certain than the supply side, but several factors are converging to provide it with solid support. In the past, copper was primarily associated with industrialization and urbanization. That’s why, when China urbanized rapidly, a key factor for copper traders to watch is China’s macroeconomic activities. China’s era of rapid urbanization was over, but several structural trends over the last decade are creating large chunks of entirely new demand.

First, there is electrification. Every solar panel needs copper. Every wind turbine needs copper. Even more importantly, we now have mass armies of electric vehicles running on batteries that are set to replace most, if not all, of the global automobile market.

What metal will benefit the most from batteries?

Cobalt? Some battery technologies won’t use cobalt because of the high cost. Nickel? Same issue. Lithium? It’s true, but as I just said, lithium is easy to mine, so any surge in demand will quickly be met by overproduction.

What about copper? The chart above was created by Bernstein, illustrating the chemical composition of all major battery technologies. You can easily see that copper makes up a significant proportion of ALL the batteries, regardless of the technologies.

The second tailwind is AI. The surging investment in AI data centers is driving a significant, structural increase in copper demand because these facilities are fundamentally more power-intensive than traditional ones. AI server racks consume significantly higher power, necessitating thicker, heavier-gauge copper cables for on-site power distribution and grounding to handle the immense electrical load safely and efficiently.

Furthermore, this high-density computing generates substantial heat, making copper indispensable for liquid cooling systems and heat exchangers due to its superior thermal conductivity.

Last but not least, the demand for copper also extends far upstream to the regional power grids, which require massive upgrades to transmission lines, substations, and transformers—all copper-intensive components—to deliver the huge amounts of energy required by these new, gigawatt-scale AI “factories.”

The final incremental demand comes from geopolitics. We live in an era of anti-globalization, where every major nation seeks to increase its share of localized production capacity. The US would want a copy of TSMC in the US. China wants the same thing. While Europe would want to rebuild its defense sector.

Even investments in green energy and AI now have a strong national security aspect. Just a few days ago, Goldman Sachs warned that the aging power grids in Europe and the United States have become a “key bottleneck” for AI development and energy security.

The final conclusion is easy. Copper is a scarce resource and costly to mine, and its cost is extremely likely to increase further. On the other hand, it’s also an indispensable metal, and the demand for it is getting ever larger, to satisfy mankind’s demand for AI, cleaner energy, and national security.

To play this theme, half of my position has been in COPX 0.00%↑, a wonderful ETF of all major copper miners around the world. The other half is Zijin Mining (2899.HK), a top-notch Chinese company that has proven itself to be a masterful consolidator of copper (and gold) assets across economic cycles.

The final great thing about copper miners is that a significant portion of gold is also embedded within them. This is because copper is often found in association with gold. The aforementioned Grasberg mine is also one of the world's largest gold mines. Zijin Mining is also a major gold miner, and has just successfully listed its gold subsidiary Zijin Gold (2259.HK) today. (Zijin Mining still controls Zijin Gold after the spin-off IPO.)

So by buying copper miners, you are also buying gold, which is another major asset class to play the “great decoupling”.

I tried to put everything into Part 2, but it seems I can only finish writing about copper! For Part 3 (and maybe more parts), I will share

My view on “disruptive transportation”, my catch-all phrase for the AV/EV space

Why is my enthusiasm for green energy not high, and for robotics, non-existent

Several key sub-themes of “China consumption”, including outdoor activities, property management, after-school education, and food & beverages

How I play the “go global” trend of Chinese brands

For your reference, this is the composition of my portfolio as of Sep 30, 2025, pre-US trading time:

By themes (mutually non-exclusive)

By types (definition)

Top 20 positions

Disclaimer: It is highly recommended that you read about my investment style to understand my numerous limitations. The information contained in this newsletter is for informational purposes only and should not be construed as financial, investment, or other professional advice. I am not a licensed financial advisor, and the information provided here does not constitute a recommendation to buy, sell, or hold any securities. Investing in financial markets involves risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial professional before making any investment decisions.

"Hebe: This asteroid in the main belt, believed to be the parent body of H-type chondrites, may contain vast quantities of pure copper. One study suggested that just the outer layer of Hebe could hold a resource supply that would satisfy Earth's needs for thousands of years."

Problem solved?

My electrical panel is something called “Silver flashed” where the bus bars are coated with silver.